Learn About Investor Fix & Flip Loans

A fix-and-flip loan is a short-term, specialized financing option for real estate investors who purchase properties to renovate them and quickly resell them for a profit or can retain them as rentals. If the property is retained as a rental, a refinance will normally take place upon completion of the renovation period into a long-term debt service vehicle such as a DSCR loan.

Key features

- Short-term in nature: Fix-and-flip loans typically have repayment terms of 6 to 18 months, as the goal is to complete the renovation and sell the property quickly.

- Property-focused valuation: Unlike traditional mortgages that dive deep into a borrower's creditworthiness, income streams, assets and other factors; fix-and-flip loans focuses primarily on the property's potential value after renovation (After-Repair Value or ARV); the investor's experience; and the actual cost of the project (Loan to cost).

- Funding for acquisition and renovation: This loan type provides the financing for both the purchase of the property and the cost of renovations, streamlining the financing process.

- Fast funding: Fix-and-flip loans are known for their quick approval and funding times, allowing investors to capitalize on time-sensitive opportunities.

- Interest-only payments: During the renovation period, borrowers typically make interest-only payments or may be able to build in interest payments into the financing which helps manage cash flow while the property is being improved.

- Higher interest rates: Due to the shorter term and higher risk associated with these loans, interest rates are generally higher than traditional mortgages. The rates are determined primarily by: investor experience; Loan to cost; loan to value & mid credit score.

- Down payment and collateral: The down payment typically ranging from 10% to 20% of the purchase price dependent on qualification factors. Fix-and-flip loans are secured by the value of the property itself, meaning the property acts as collateral.

- Fix & Flip loans are usually held in entities such as LLC’s but are personally guaranteed.

Who uses them

Fix-and-flip loans are primarily utilized by real estate investors who specialize in buying, renovating, and selling properties for profit. This includes experienced flippers, beginners looking to enter the market, general contractors expanding into real estate, and real estate professionals seeking to leverage their industry knowledge.

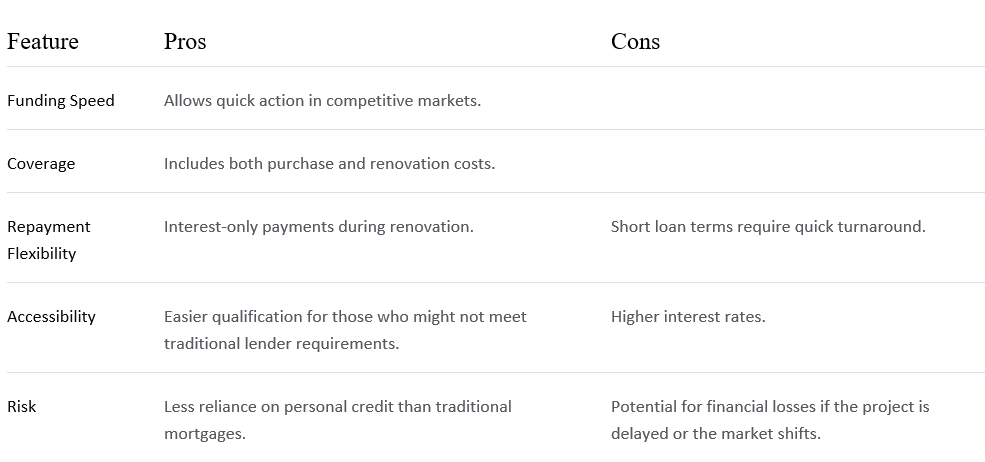

Pros and cons

Debt Service Coverage Ratio Loans or DSCR

A Debt Service Coverage Ratio (DSCR) loan is a type of real estate investment loan where the loan approval and terms are primarily based on the cash flow of the property rather than the borrower's personal income and debts.

Key features

- Focus on property cash flow: Unlike traditional mortgages, where a borrower's income, employment history, and tax returns are reviewed for qualification, DSCR loans prioritize the property's ability to generate enough rental income to cover the projected monthly mortgage payment.

- Calculating DSCR. This ratio compares a property's gross Operating Income to its total debt service - mortgage payments including real estate taxes, insurance and any HOA. DSCR loans normally generate more income than the monthly debt service but some investors will allow a negative cash flow with compensating factors.

- Benefits for investors: This loan structure is particularly beneficial for real estate investors who may not qualify for traditional financing or desire to streamline the paperwork involved in qualification due to:

- Fluctuating or non-traditional income sources (self-employed individuals, freelancers, etc.).

- Operating under a business entity (like an LLC) for liability protection and wanting to keep personal and business finances separate.

- Desire to scale their rental portfolio, as DSCR loans often have no limit on the number of properties that can be financed.

- Needing faster funding and a streamlined application process, as DSCR loans require less personal income documentation.

- Property requirements: DSCR loans are generally for investment properties, such as:

- Single-family rentals

- Multi-unit properties

- Commercial real estate

- Short-term or long-term rentals

DSCR loans offer a flexible and accessible financing solution for real estate investors focused on building income-generating portfolios. They cater to investors with varying income structures and those who prioritize the financial performance of their properties over personal income when seeking loan approval. These loans offer distinct advantages in terms of qualification and scalability.

At Renovation Lender - Mark Vernon, we can help find the perfect Investor Fix & Flip Loans for you and your specific needs. Contact us today!